Accountability report 2023/24

This information is part of our Annual report and accounts 2023/24

Our Accountability Report outlines key features of how we manage our organisation. It has three sections.

Over the following pages our Corporate Governance report explains who our Board and senior management team are, how they work and the governance arrangements in place to ensure effective management and oversight of our resources to achieve our objectives.

Our Remuneration and Staff Report describes how we address Board and senior management pay as well as providing an overview of the make-up of our staff numbers.

Our Parliamentary Accountability and Audit Report brings together additional requirements requested to demonstrate our accountability to the UK and Welsh Governments, regularity of expenditure and the opinion from our external auditor.

Corporate governance report

Directors’ report

The Chief Executive is supported by a team of Executive Directors who together form our Executive Team (ET). There have been no changes to the Executive Team during 2023/24

|

Name |

Post Holder |

Length of ET Service |

|---|---|---|

|

Chief Executive |

Clare Pillman |

26 February 2018 - present |

|

Executive Director of Evidence, Policy and Permitting |

Ceri Davies |

1 April 2013 - present |

|

Executive Director of Operations |

Gareth O’Shea |

27 April 2015 – present |

|

Executive Director of Corporate Strategy and Development |

Prys Davies |

1 April 2019 – present |

|

Executive Director of Finance & Corporate Services |

Rachael Cunningham |

7 September 2020 – present |

|

Executive Director of Communications, Customer and Commercial |

Sarah Jennings |

7 September 2020 – present |

Our Executive Team Register of Interests as at March 2024 is included here.

|

Name |

Position |

Interest |

Individual |

Role |

|---|---|---|---|---|

|

Clare Pillman |

Chief Executive |

Land / Property |

Personal |

Resident in an area that may be considered for the proposed new National Park |

|

Clare Pillman |

Chief Executive |

Executive or Non-Executive Board, Committee or Trust Membership |

Personal |

Member of Welsh National Opera Board |

|

Ceri Davies |

Executive Director of Evidence, Policy and Permitting |

Other |

Personal |

Member of the Chartered Institute of Waste Management |

|

Ceri Davies |

Executive Director of Evidence, Policy and Permitting |

Executive or Non-Executive Board, Committee or Trust Membership |

Personal |

Trustee of Keep Wales Tidy |

|

Prys Davies |

Executive Director of Corporate Strategy and Development |

No interests to declare |

N/A |

N/A |

|

Gareth O’Shea |

Executive Director of Operations |

No interests to declare |

N/A |

N/A |

|

Rachael Cunningham |

Executive Director of Finance & Corporate Services |

No interests to declare |

N/A |

N/A |

|

Sarah Jennings |

Executive Director of Communications, Customer and Commercial |

No interests to declare |

N/A |

N/A |

The Chair’s declaration of interests is reviewed by the Chair of the Audit and Risk Assurance Committee and the Head of Governance & Board Secretary.

The Register of Interests for our Board members is available here.

Ceri Davies, Executive Director for Evidence, Policy and Permitting and Temporary Acting Accounting Officer - 16 October 2024

Statement of Accounting Officer’s Responsibilities

Paragraph 23 of the Schedule to the Natural Resources Body for Wales (Establishment) Order 2012 requires us to produce, for each financial year, a Statement of Accounts in the form and on the basis set out in the Accounts Direction. The accounts are prepared on an accruals basis and must give a true and fair view of the state of affairs of the organisation and of the income and expenditure, changes in taxpayers’ equity and cash flows for the financial year.

In preparing the accounts, the Accounting Officer is required to comply with the requirements of the Government Financial Reporting Manual (FReM) and to:

- observe the Accounts Direction issued by HM Treasury including the relevant accounting and disclosure requirements and apply suitable accounting policies on a consistent basis

- make judgements and estimates on a reasonable basis

- state whether applicable accounting standards as set out in the FReM have been followed, and disclose and explain any material departures in the financial statements

- prepare the financial statements on a going concern basis

- confirm that there is no relevant audit information of which our auditors were unaware, and take all steps to make themselves aware of any relevant audit information and to establish that NRW’s auditors are aware of that information

- confirm that the Annual Report and Accounts as a whole is fair, balanced and understandable and take personal responsibility for it and the judgements required for determining that it is fair, balanced, and understandable.

The Additional Accounting Officer for the WG has designated the Chief Executive of NRW as its Accounting Officer. The Chief Executive’s responsibilities as Accounting Officer are the propriety and regularity of the public finances for which she is answerable; the keeping of proper accounts; prudent and economical administration; avoidance of waste and extravagance; and the efficient and effective use of all the resources as set out in the Memorandum for the Accounting Officer for NRW.

Governance statement

This Statement sets out the governance structures, internal control and assurance frameworks that have operated within the organisation during the financial year 2023/24 and accords with HM Treasury and Managing Welsh Public Money guidance.

As the designated Accounting Officer for the organisation, my role is also to safeguard public funds and organisational assets by putting in place arrangements for the governance of our affairs and effective exercise of our functions. I can confirm that the information in our Annual Report and Accounts is a true and fair account of how the organisation has delivered its functions this year. I also confirm that there is no outstanding information that has been brought to my attention or that I am aware of that has not been brought to the attention of Audit Wales.

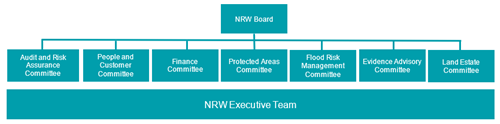

Our governance structure

Our organisational structure shows how we are set up to work and deliver our objectives.

Our Board members are appointed by Welsh Ministers in accordance with the Code of Practice for Ministerial Appointments in Public Bodies, and as such our Chair is accountable to our sponsor minister in the Welsh Government.

We currently have 12 remunerated Board members, led by our Chair, Sir David Henshaw, with 10 non-executive members and me as an executive member of the Board. There is currently a non-executive member vacancy within the Board structure. Professor Steve Ormerod is the appointed Deputy Chair of the organisation and Helen Pittaway is the Senior Independent Director (SID). The role of SID was introduced to support the Chair in his role; to act as an intermediary for other non‑executive directors when necessary; to lead the non-executive directors in the oversight of the Chair and to ensure there is a clear division of responsibility between the Chair and Chief Executive. There were eight changes to our Board this year: the term of Zoe Henderson ended on 8 May 2023, Julia Cherrett’s term ended on 31 May, and Professor Peter Rigby’s term ended on 31 October. Kathleen Palmer, Helen Pittaway, Professor Peter Fox, and Professor Rhys Jones were appointed as Non-Executive Directors from 16 February 2023, and Lesley Jones was appointed as a Non-Executive Director from 1 June 2023.

To carry out our duties, we meet as a full Board with additional scrutiny being undertaken by seven committees. Our Executive Team (ET) provides strategic and operational updates to our Board and committees for scrutiny and decision as required.

Each committee is chaired by a non-executive Board member and, with the exception of the Evidence Advisory Committee (EAC), each includes at least three other non-executive Board members. Due to the non-executive member vacancy, the People and Customer Committee (PCC) has only two other non-executive Board members at this time. Other non-executive Board members have an open invitation to attend committee meetings in a non-voting capacity. We do not have a Nominations Committee, as our non-executive Board members are appointed by Welsh Ministers. The following sections outline the work focus areas and attendance of our Board and committees.

|

Non-Executive members |

Term |

Start date |

Current end date |

|---|---|---|---|

|

Sir David Henshaw (Chair) |

2 |

1 November 2018 |

31 October 2025 |

|

Zoe Henderson |

2 |

9 November 2015 |

8 May 2023 |

|

Professor Steve Ormerod |

2 |

1 November 2018 |

31 October 2025 |

|

Dr Rosie Plummer |

2 |

1 November 2018 |

31 October 2024 |

|

Julia Cherrett |

2 |

1 November 2018 |

31 May 2023 |

|

Professor Peter Rigby |

2 |

1 November 2018 |

31 October 2023 |

|

Geraint Davies |

2 |

1 January 2019 |

31 October 2024 |

|

Professor Calvin Jones |

2 |

1 September 2021 |

31 October 2028 |

|

Mark McKenna |

2 |

1 September 2021 |

31 October 2028 |

|

Professor Peter Fox |

1 |

16 February 2023 |

31 October 2026 |

|

Helen Pittaway |

1 |

16 February 2023 |

31 October 2026 |

|

Kathleen Palmer |

1 |

16 February 2023 |

31 October 2026 |

|

Professor Rhys Jones |

1 |

16 February 2023 |

31 October 2027 |

|

Lesley Jones |

1 |

1 June 2023 |

31 October 2026 |

Board meetings

We held six two-day meetings and two development days across Wales this year. Two meetings were held virtually and four were held face to face. Members of the public were able to virtually attend and observe our six meetings held in public. Standing items on our agenda include: response to Climate and Nature Emergencies; in-year finance; performance reporting; and strategic and operational updates from the Chair, Chief Executive and committees.

We publish a wide range of information regarding our work on our website, including papers to be considered by the Board in advance of those meetings held in public. Board papers are prepared using the latest evidence available and receive internal scrutiny and approval prior to Board meetings.

All future public meeting dates and previous agendas are available on our website, as well as the papers and minutes from our public sessions.

Board member attendance 2023/24

|

Name |

Meeting Attendance |

|---|---|

|

Sir David Henshaw (Chair) |

6/6 |

|

Professor Steve Ormerod |

6/6 |

|

Julia Cherrett |

1/1 |

|

Geraint Davies |

6/6 |

|

Professor Peter Fox |

5/6 |

|

Professor Calvin Jones |

4.5/6 (Attended 1 of 2 days of the May meeting) |

|

Lesley Jones |

4/5 |

|

Professor Rhys Jones |

6/6 |

|

Mark McKenna |

6/6 |

|

Kathleen Palmer |

5/6 |

|

Helen Pittaway |

6/6 |

|

Dr Rosie Plummer |

6/6 |

|

Professor Peter Rigby |

3/3 |

|

Clare Pilman (Chief Executive) |

6/6 |

Audit and Risk Assurance Committee

The Audit and Risk Assurance Committee’s (ARAC) principal role is to advise the Board and support the Accounting Officer in monitoring, scrutinising and challenging the arrangements in place for audit, governance, internal controls and risk management. The Chief Executive attends every meeting as the organisation’s Accounting Officer, along with our Executive Director of Finance and Corporate Services. Members of ET attend the committee to discuss any limited assurance internal audit reports.

This year ARAC addressed a range of issues including:

- Improvements to our risk management approach

- Revised strategic risk register

- Organisational assurance mapping

- Internal Audit Plan 2023/24

- Annual Report and Accounts 2022/23 and preparation for 2023/24

- Cyber risk

Board member ARAC attendance 2023/24

|

Name |

Meeting Attendance |

|---|---|

|

Kathleen Palmer (Chair) |

5/5 |

|

Lesley Jones |

1/2 |

|

Professor Rhys Jones |

5/5 |

|

Dr Rosie Plummer |

5/5 |

|

Professor Peter Rigby |

3/3 |

People and Customer Committee

The People and Customer Committee (PCC) considers matters relating to people management, reward, and organisational change. This includes oversight of the pay and conditions of employment of the most senior staff, an overall pay strategy for all staff employed by us, pension scheme provision, organisational design, wellbeing, health and safety, customer care, equality and diversity and development of the Welsh language scheme. The Chief Executive attends every meeting.

The Committee addressed a range of issues during the year including:

- Wellbeing, Health and Safety and Serious Incident Reviews

- Recruitment and the Recruitment Process

- Stakeholder Programme

- People Transformation Programme

- Equality, Diversity and Inclusion

- Customer Experience and Engagement

Board member PCC attendance 2023/24

|

Name |

Meeting Attendance |

|---|---|

|

Mark McKenna (Chair) |

4/4 |

|

Professor Rhys Jones |

1/1 |

|

Helen Pittaway |

4/4 |

|

Dr Rosie Plummer |

4/4 |

Finance Committee

The Finance Committee provides advice, oversight, and scrutiny on strategy, management and performance in relation to finance, business planning and performance, charge schemes, and commercial matters. In carrying out its role, the Committee focuses on strategic direction and development, however it also has a role in scrutinising performance and delivery.

This year the Committee considered the following:

- Monitoring in-year financial performance

- Financial and Business Planning for 2024/25

- Annual Review of Charges

- Commercial Activities

- Timber sales and marketing oversight

- Programme Management Office and Contract Management Support Service

Board member Finance Committee attendance 2023/24

|

Name |

Meeting Attendance |

|---|---|

|

Sir David Henshaw |

6/8 |

|

Helen Pittaway (Chair) |

7/8 |

|

Professor Calvin Jones |

8/8 |

|

Professor Peter Fox |

5/8 |

Protected Areas Committee (PrAC)

The Board has delegated its statutory responsibilities in relation to legislation concerned with nature conservation and protected landscapes to the Protected Areas Committee (PrAC). PrAC members also support the Executive and Board by providing advice on wider protected area issues and strategic casework, including landscape management, Designated Landscapes, and NNRs.

The Committee reviewed areas including:

- Designated Landscape Programme

- Special Areas of Conservation (SAC) Rivers Project

- Biodiversity Policy

- Protected Sites delivery

- Marine conservations zones

Board member PrAC attendance 2022/23

|

Name |

Meeting Attendance |

|---|---|

|

Dr Rosie Plummer (Chair) |

3/3 |

|

Geraint Davies |

3/3 |

|

Lesley Jones |

3/3 |

|

Professor Steve Ormerod |

3/3 |

Flood Risk Management Committee

The Committee is advisory and reports to our Board.

Its primary responsibilities are to scrutinise Flood Risk Management (FRM) investment programmes for current and future years, and to consider key issues which may affect the delivery of FRM related work in Wales.

The Committee usually comprises four non-executive members of the Board along with the Executive Director of Operations and the Head of Flood Incident Risk Management.

FRMC reviewed areas including:

- Prioritisation of flood risk management activities

- Governance of the flood risk management capital programme

- Oversight of the flood recovery and review implementation programme

- Oversight of work to improve our regulation of reservoir safety

- Asset Management

Board member FRMC attendance 2023/24

|

Name |

Meeting Attendance |

|---|---|

|

Professor Peter Fox (Chair) |

4/4 |

|

Geraint Davies |

4/4 |

|

Professor Calvin Jones |

4/4 |

|

Lesley Jones |

3/3 |

|

Helen Pittaway |

1/1 |

Evidence Advisory Committee

The Evidence Advisory Committee (EAC) is advisory and provides independent advice and challenge in relation to our evidence function. The Committee also helps to strengthen understanding in the wider research community, and with evidence users in government, of evidence processes and priorities.

The Committee comprises two non-executive members of the Board and eleven independent external members with an understanding of the Welsh context, to offer a diverse range of appropriate expertise.

EAC reviewed areas including:

- Our State of Natural Resources Report

- Citizen Science

- Peatland Programme

- Nature Networks Programme

- LIFE Projects

Board member EAC attendance 2023/24

|

Name |

Meeting Attendance |

|---|---|

|

Professor Peter Rigby (Chair) |

2/2 |

|

Professor Steve Ormerod |

3/3 |

|

Professor Rhys Jones |

1/1 |

Land Estate Committee

The Land Estate Committee (LEC) provides the Board with advice and assurance in relation to the sustainable management of our land estate, including investment in the estate, its management, and proposals for changes in its use, and makes specific decisions and undertakes specific functions as delegated to it by the Board.

LEC reviewed areas including:

- Recreation Strategy

- Trydan Programme (formerly the Renewable Energy Developer Programme)

- Alternative Timber Sales Process and the Timber Industrial Strategy

Board member LEC attendance 2023/24

|

Name |

Meeting Attendance |

|---|---|

|

Professor Calvin Jones (Chair) |

3/3 |

|

Geraint Davies |

2/3 |

|

Professor Peter Fox |

2/3 |

|

Mark McKenna |

3/3 |

While Fora are not a part of our formal governance structure, non-executive Board members Chair, or attend at, these meetings.

Board Member reviews

The Chair carries out annual appraisals with each Non-Executive Director and the Chief Executive, and the review process includes a short self-assessment and priorities for the next year. The Chief Executive undertakes mid- and end-year appraisals with the five Executive Directors.

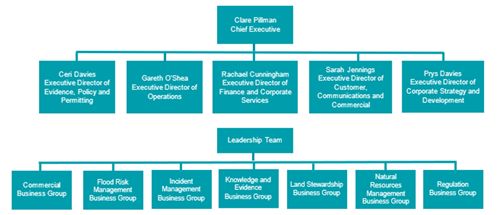

Our Executive

Day-to-day management of our organisation is delivered through the ET, comprising myself as Chief Executive and five Executive Directors who report to me. ET meet twice each month to consider core corporate business, for example finance updates, performance information, wellbeing health and safety, review and scrutinise the strategic risk register, etc. They also scrutinise and consider decisions concerning strategy, policy, and operational issues.

Below ET, our Leadership Team plays a leading role in managing the business on a day-to-day basis. Its members are all the Heads of departments that report to our ET including those in our corporate functions (such as Finance, HR, and Communications).

Our structure emphasises place-focussed delivery: seven Heads of Place within the single Operations Directorate each oversee delivery of all our functions in a specific region of Wales. We then have nominated Heads of Service (who are each also a Head of Place) who take a lead for overseeing delivery of a particular function throughout Wales. The Heads of Service work closely with our policy leads - called Heads of Business – who oversee the strategic direction of our work across Wales.

To ensure a join up between strategic thinking and operational delivery, we have a series of Business Groups which set the policy requirements and plan the operational nature of our work across the place-focussed structure. These are each led by the Head of Business / Head of Service.

In June 2023 we launched our new corporate plan, Nature and People Thriving Together, setting out our vision, mission and well-being objectives to 2030 and beyond. The plan highlights how we will play our part in the Team Wales approach to tackling the nature, climate, and pollution emergencies.

To complement the publication of our corporate plan, we committed to strengthening our performance management framework. Through 2023/24 we have designed an outcome-focussed approach to measure our progress towards the corporate plan well-being objectives. There are three levels:

- strategic and long term – with impacts and strategic indicators defined for 2030

- operational and medium term – multi-year planning to reach the ambition of the steps to take and well-being objectives with trend metrics reporting the “health” status over time

- operational and short term – annual commitments and key results to show progress in year

Together, these provide an integrated perspective, enabling us to reflect on progress towards our outcomes, identify what is driving delivery, what is hindering progress and where things need to change. We will use these insights, along with information relating to risk appetite, tolerance levels and risk profile, to inform prioritisation and the allocation of resources on an annual basis.

In 2023/24, we focussed on the development of the strategic, long-term impact statements and strategic indicators working collaboratively across the organisation. They have been published in draft and will be tested through 2024/25, using them to frame our Board strategic deep-dive sessions, while also engaging with partners to share insight and identify opportunities for collaboration. We will finalise these impacts and indicators in the autumn of 2024 and they will remain in place from 2025/26 to 2030 to monitor progress.

In 2024/25 we will focus on the operational and medium term through the development of the approach to multi-year planning and trend metrics. The multi-year planning will focus on the WBO steps to take, defining metrics which set the stretch to ensure we are on the pathway to meeting the 2030 ambition. Tracking these metrics will provide powerful insight and learning on the progress towards, or the gap between, achieving the long-term strategic impacts and strategic indicators and “turning the curve”. It will highlight those things that need to change not only within our direct control but also beyond, in the work of Government, partners and other public bodies.

The operational multi-year planning metrics will define the stretch that the short-term annual business plan will respond to. The annual business plan will identify those things that need to happen in a year to drive the change we want to see, for example testing new approaches or streamlining processes. This approach is setting us on a pathway to be a different organisation, measuring those things that are important and using this to drive our decision making on priorities.

For the 2023/24 Business Plan our Board agreed to roll forward those measures from the 2022/23 business plan that align to the new vision, mission and well-being objectives, creating capacity for the development work on the performance management framework. The business plan sets out what we will deliver in 2023/24, the first year of the new corporate plan, and the resources (staff and financial) we will use to do this.

As a Category One responder under the Civil Contingencies Act 2004, we have continued to undertake our legal responsibilities to work with the emergency services, local authorities and other partners to plan for, respond to, and aid recovery from incidents affecting people and the environment across Wales 24 hours a day, 365 days a year.

From flooding, pollution, wildfires or incidents on the land we manage and at our regulated sites, we have direct responsibilities when it involves environmental incidents in our remit.

For many incidents we were the sole or lead responder. But on many occasions, we worked with our partners in an integrated and effective way to minimise the impacts to people and wildlife and reduce the time it takes for communities and the environment to recover.

We have continued to train and develop staff, enabling them to support our duty rotas effectively. Consequently, we now have more staff available to support our incident response efforts around the clock. Additionally, we actively trained more staff to further strengthen our rotas for the future. Staff members have participated in numerous internal and external incident exercises, allowing us to continuously enhance our capabilities. We are committed to building on the lessons learned from these exercises and from actual incidents to improve the service we provide, particularly as we confront the challenges posed by the increasing number of incidents stemming from climate and nature emergencies.

Ministerial Directions

We have received one Ministerial Direction this year. In January 2024, we issued a derogation notice to Welsh Ministers in respect of a marine license application for the proposed Barmouth flood alleviation scheme. In response, the Minister for Climate Change directed us not to approve the plan set out in the derogation notice until such time that they wrote again to confirm whether we could proceed to approve the plan. Following a review of our documentation by the Minister’s officials, the Minister wrote to us on 13 February to confirm that they were content for us to proceed to approve the plan.

Our Internal Control Framework

Our internal control framework consists of policies, procedures, measures, and accreditations we have in place to protect our resources while we deliver our objectives.

Our key financial controls within automated systems and our schemes of delegation to ensure appropriate segregation of duties remain in place and current. The Managing our Money, Delegated Authority Schedule, and our Statutory and Legal Scheme documents are reviewed regularly.

Risk Management

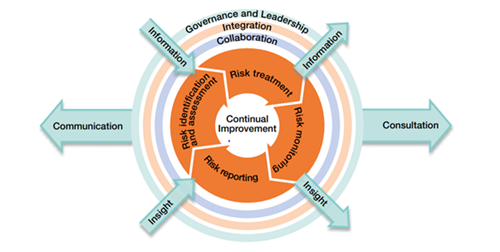

A robust risk management framework is an essential component of our overall corporate governance framework. It assists us in managing the organisation to ensure we give ourselves the best chance to deliver on our wellbeing objectives, protecting our resources and our reputation.

Risk Management Framework

Our risk management process is structured to include: risk identification and assessment to determine and prioritise how the risks should be managed; the selection, design and implementation of risk treatment options that support achievement of intended outcomes and manage risks to an acceptable level; the design and operation of integrated, insightful and informative risk monitoring; and timely, accurate and useful risk reporting to enhance the quality of decision-making and to support management and oversight bodies in meeting their responsibilities.

The framework draws on a number of best practice standards, namely the Orange Book, and sets out the framework to support the management of risks and opportunities across the organisation. The principles of the framework underpin the way in which we need to undertake risk management effectively to ensure that it is an essential part of governance and leadership, it feeds effectively into and informs decision making, it enables insightful and informative risk monitoring and provides accurate risk reporting.

Our risk strategy is set and approved by the Board. Our risk management policy which includes a RACI (Responsible, Accountable, Consulted, Informed) and an escalation process is set and approved by our Executive Team.

Risk Appetite

We are a large organisation, with many diverse and complex functions and roles and therefore, our willingness to accept and pursue risk will vary across the organisation. Risk appetite is an expression of the types and amounts of risk we are willing to take or accept to achieve its wellbeing objectives. Our risk appetite clarifies the options available to us, the risks that we can take and those which we need to avoid or reduce as a priority.

Our Board sets and reviews our agreed risk appetite annually. Understanding and setting a clear risk appetite level is essential to achieving an effective risk management framework.

Strategic risk management

Our strategic risk and assurance register is owned by the Executive Team with each risk being owned by an individual Director. The delivery of our Corporate Plan in April 2023 provided both a need and an opportunity to challenge and redevelop the risks at the strategic level needed to underpin and support effective delivery of our well-being objectives within the corporate plan. The strategic risks are managed through regular review and are also subject to deep dives by the Executive Team as well as the relevant Board Committee.

Each strategic risk has a risk appetite level assigned to it with a more detailed individual risk appetite statement providing more instruction and direction to the risk owner to support in the effective management of the risk.

Oversight of the risk management framework and its effectiveness is undertaken by the Audit and Risk Assurance Committee (ARAC) who in turn provide assurance to the Board. The Board undertake an annual review of the strategic risks to seek assurance that the register includes the key risks needed to support the delivery of the corporate plan.

Information assurance

We are committed to ensuring data and information is well governed and managed, and that we continue to achieve a balance between openness and security, making sure that staff and customers are assured of suitable levels of protection. The Senior Information Risk Owner (SIRO) continues to lead an integrated programme of work to strengthen our response to resilience against cyber and information security threats. We have once again passed our annual Cyber Essential Plus accreditation which is approved by the National Cyber Security Centre and independently audited by a qualified third-party specialist. We will continue to deliver a cyber security programme of work based on our cyber strategy. This includes initiatives for improving staff awareness, including cyber security online training. We also undertaking quarterly tabletop exercises to test our procedures and response to an Information Security incident.

We have mandatory bi-annual online learning courses for staff on UK General Data Protection Regulation (GDPR), Computer Security in the Workplace and Information Security to ensure everyone is aware and up to date on how we manage the information we receive and hold. Completion rates of mandatory online learning continue to improve with these being supplement with targeted awareness sessions. We continue to collaborate with strategic partners such as WG, Data protection Community, local resilience forum and the National Cyber Security Centre to share learning and maintain standards.

This year, as a precaution, we reported one incident to the Information Commissioners Office (ICO). The ICO requested for anyone impacted by the Capita Pensions System Data Breach to inform them. Although we are not a Data Controller for this data, we felt it was appropriate to report this to the ICO for transparency and to detail what measures we were taking to support our impacted staff members. We have received confirmation from the ICO that no further action will be taken against us for this breach and that they are still investigating this with Capita.

Number of cases reported to the Information Commissioner’s Office (ICO)

|

Year |

Number of cases |

|---|---|

|

2023/24 |

1 |

|

2022/23 |

0 |

|

2021/22 |

0 |

Declaration of interest

Our Conflict of Interest policy and guidance support all staff and Board members with our continuous process to declare relevant personal interests to help us manage any potential or perceived conflicts with their professional roles. A scheduled review of our Conflict of Interest policy, procedures, training, and reporting mechanisms is currently being undertaken.

Raising a serious concern in the public interest

Raising a Serious Concern in the Public Interest within NRW

We are committed to the highest standards of openness, probity, and accountability. There is an expectation that all those who work for us who have serious concerns about any aspect of our work is able to come forward and voice those concerns. We are committed to taking whatever action is necessary to address any wrongdoing which is uncovered.

Therefore, we have established measures in place to raise serious concerns about malpractice or impropriety. Our framework includes access to a telephone contact number and on-line form, where concerns can be raised anonymously if preferred.

During 2023/24 there were 27 potential whistleblowing cases reported via the whistleblowing mechanisms. All were considered in line with our whistleblowing policies and procedures. Of these 27 reports, 2 were reviewed and handled formally as whistleblowing cases and another 2 were handled via our fraud investigation procedures, 8 related to matters outside of the organisation and 15 were not considered as whistleblowing, as defined by our Whistleblowing Policy, so were referred back to the business for internal handling.

Of the 2 cases handled formally as whistleblowing cases, 1 was not upheld and 1 is pending completion of the investigation.

Number of whistleblowing cases

|

Year |

Number of cases |

|---|---|

|

2023/24 |

27 |

|

2022/23 |

7 |

|

2021/22 |

4 |

NRW as a Prescribed Person for Raising a Serious Concern in the Public Interest

We became a became a ‘Prescribed Person’ in 2020 following an approach from WG. The Prescribed Persons Order 2014 sets out a list of 60 organisations that any member of the public may approach to report suspected or known wrongdoing (whistleblowing). The organisations and individuals on the list have usually been designated as a prescribed person because they have an authoritative or oversight relationship with their sector, often as a regulatory body. The Order is amended, by the UK Government, each year, to ensure that the list remains up to date.

There were 4 cases of a Prescribed Person Whistleblowing Report received from 1 April 2023 to 31 March 2024, although it is acknowledged other concerns may have been raised outside of the formal whistleblowing process.

Of those 4 cases received, 2 were handled formally as whistleblowing cases. 1 was not upheld and 1 is pending completion of the investigation. The remaining 2 cases were referred to the incident handling teams within the organisation and handled under the normal complaints processes.

Fraud

Our Counter Fraud Strategy 2022–2026 sets out the strategic direction designed to support and strengthen our ability to protect itself from the harm that fraud can cause. Focusing this strategy on best practices and professional standards will help ensure that an anti-fraud approach becomes integral to the way we work. Our Counter Fraud Strategy is supported by a revised Counter Fraud, Bribery and Corruption Policy and a Fraud, Bribery, and Corruption Response Procedure.

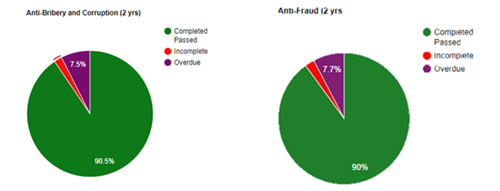

We remain in a cost of living crisis and pressures such as those caused by high rates of inflation can lead to an increased risk of fraud, which is already the most frequently reported category of crime in the UK. Mandatory online learning courses are provided for staff on Anti-Fraud and Anti-Bribery and Corruption. These courses are designed to help staff identify red flags and ensure they are aware of their professional responsibilities. The completion rates for these modules remain high.

eLearning Completion Stats for 2023/24

As part of our prevention and detection work, risk assessments have been undertaken to identify the areas of the organisation at greatest risk of fraud and to focus our mitigating controls here. We also participate in the National Fraud Initiative, a data matching exercise designed to detect fraud and error across payments systems.

Last year we received 9 allegations of fraud, 7 handled as per our fraud investigations procedures, 1 handled under whistleblowing procedures and 1 handled by NRW’s HR procedures. All fraud cases are reported to the Audit and Risk Assurance Committee. All investigations have been managed by an Accredited Counter Fraud Specialist or similarly qualified external investigators. The final report on each case is referred to independent senior staff.

Number of allegations reported

|

Year |

Allegations |

|---|---|

|

2023/24 |

9 |

|

2022/23 |

8 (This figure was incorrectly reported as 5 in last year’s annual report, but the quarterly reporting to ARAC was correct.) |

|

2021/22 |

8 |

Whilst robust counter fraud arrangements are part of the our response, we also have a responsibility to support our employees and their families. Accordingly, colleagues in People Services continue to work on a range of initiatives to support anyone struggling financially and offer help where we can.

Compliance with required codes and guidance

We have completed a review and established that our organisational structure, policies, procedures, and practices comply with the requirements of Chapter Six: Arm's length bodies, of the Corporate Governance Code for Central Government Departments.

The Accounting Officer is supported by a Board structure in line with the Corporate Governance Code for Central Government Departments, and there are supporting procedures in place to ensure Board roles can operate effectively.

As regulated appointments, the appointment of the Chair and Board members are made in accordance with the Commissioner for Public Appointments’ Code of Practice.

The Accounting Officer is also responsible for ensuring a system of good corporate governance and assurance is in place, in line with the principles of the Corporate Governance Code for Central Government Departments.

Our leadership is consistent with expected senior management roles and responsibilities, ensuring; our reporting routes are clear to ensure accountability and appropriate division of duties and key internal controls are in place; remuneration of senior staff is considered by non‑executives to ensure independence and we have regular meetings with our key stakeholders to maintain constructive working relationships.

Our organisational framework of risk management is established in line with and to enable the application of the Orange Book’s five principles, as follows:

- Risk management is an essential part of governance and leadership, and fundamental to how the organisation is directed, managed and controlled at all levels.

- Risk management is an integral part of all organisational activities to support decision-making in achieving objectives.

- Risk management is collaborative and informed by the best available information and expertise.

- Risk management processes are structured to include:

- Risk identification and assessment

- Selection, design and implementation of risk treatment options

- Design and operation of integrated insightful and informative risk monitoring

- Timely, accurate and useful risk reporting to enhance decision making and oversight

- Continuous improvement through learning and experience.

Our assurance framework

Our assurance framework comprises of the following measures which are in place to ensure I receive timely evidence that the controls required are in place and working appropriately.

Internal audit

The annual audit opinion is informed in part by the delivery of the Internal Audit plan. This year we provided an “unsatisfactory assurance” for one audit area of ICT Assurance and all other audits were moderate or substantial. A risk maturity review has provided a level 2 of maturity (scale 1-5) and it is recommended that NRW works towards increasing maturity to level 3. This improvement will see risk management implemented in all key areas, currently NRW’s risk management has the fundamentals in place and has planned for better implementation across NRW. At present NRW’s risk management is not mature enough to prevent materialisation of risks from causing business disruption. NRW has set up the NRW 2030 Programme in part to address the noted weakness in the internal control framework for ICT, with a project for ICT Stabilisation being undertaken. People resourcing remains a challenge within NRW due to budgetary pressures across the public sector, but it is noted that NRW has taken a prioritisation approach to resourcing pressures.

In conclusion, my professional evaluation of internal controls, governance and risk management has led me to conclude that that in 2023/24 there remains improvements required to enhance the adequacy and effectiveness of the framework of governance, risk management and control. I can therefore offer a moderate overall assurance opinion for the past year. It is noted that NRW continues to progress considerable amounts of planned work to address identified weaknesses in governance, risk and control.

External audit

Independent scrutiny forms an important source of assurance, providing evidence of our ways of working in relation to best practice and industry standards. In some parts of the organisation, we are subject to, or we opt for, external audits or reviews of our work. Some are annual, for example UK Woodland Assurance Scheme or the ISO14001:2015 to maintain our environmental management system. Others we request as one of many pieces of work to give ourselves further information about particular areas or activity.

Effectiveness of the system of internal controls

The system of internal control is based on the systems, structures and principles in operation within the organisation that mitigate and manage the risks to our aims and objectives. We are responsible for maintaining a sound system of internal control that simultaneously supports the achievement of our aims and objectives, whilst also safeguarding the public funds and the organisation’s assets for which we are responsible.

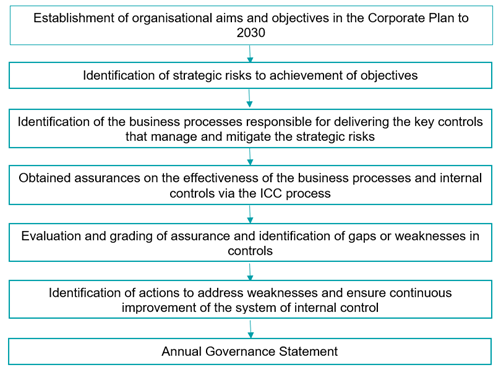

To enable us to provide assurance in regard to the effectiveness of our system of internal control a review process has been undertaken, this process is known as the Internal Control Checklist (ICC) and culminates in the signing of a Certificate of Assurance by each Executive Director for their areas of delegated authority. The certificate of assurance in then submitted to the Accounting Officer. The key elements of the review process are set out below:

This year further developments were integrated into the process, including:

- the introduction of quarterly reviews following the completion of the 2022-2023 ICC process. This provided Executive Directors the opportunity to regularly consider any changes to their level of assurance in relation to the effectiveness of internal controls within their directorate throughout the year as a continuous review process;

- the introduction of a mandatory survey for the Leadership and Management Teams, directly linked to the business processes responsible for delivering key controls;

- increased maturity and clarity in relation to categorisation of the assurance received in regard to both the three lines model and triangulated assurance; and

- increased focused on the identification of gaps/weaknesses in the system of internal control and the development of a subsequent action plan.

The ET have considered and moderated the analysis of the results and the assurance gradings attributed by Directors, and have endorsed the actions identified to remedy any significant weaknesses identified.

The following weaknesses within the system of internal control, and the corresponding steps taken/actions to address have been identified as a result of the review of the system of internal control:

|

Issue identified |

Actions to address |

Responsible area |

|---|---|---|

|

Workforce |

One of the four elements of the NRW to 2030 Transformation Portfolio is the People Transformation Programme, which consists of a number of formal sub-projects. The programme is intended to significantly improve workforce systems and processes, and will strengthen controls across the service enabling the organisation to efficiently deliver the Corporate Plan and Wellbeing Objectives. Formal projects included within the programme which are due to be progressed or completed in 2024/25 include:

|

Organisational development |

|

ICT |

Another of the four elements on the NRW to 2030 Transformation Portfolio is the Tech Transformation Programme, which consists of a number of formal sub-projects. The programme is intended to significantly improve workforce systems and processes, and will strengthen controls across the service enabling the organisation to efficiently deliver the Corporate Plan and Wellbeing Objectives (WBO). Formal projects included within the programme which are due to be progressed or completed in 2024/25 include:

|

ICT |

|

Wellbeing Objectives (Governance and Oversight) |

The new corporate plan cycle has enabled us to review our approach to planning and performance. Our refreshed performance management framework will ensure a clear line of sight from the strategic to operational delivery. 2024/25 is a development year, in which we will also review policy and guidance for governance and oversight of the WBOs.

Through this developmental year, we will ensure a cohesive approach to WBO governance and performance across the above elements. This will drive our decision making on priorities. |

Corporate Strategy and Programme Management Office |

Ceri Davies, Executive Director for Evidence, Policy and Permitting and Temporary Acting Accounting Officer - 16 October 2024

Remuneration and Staff Report (audited)

Remuneration policy

The Board has established a committee (PCC) to consider matters relating to the pay and conditions of employment of the most senior staff and overall pay strategy for all staff employed by the organisation. The PCC comprises four non-executive Board members. The Board Chair is an ex-officio member of the Committee.

The Chair and Board members’ remuneration is set by Welsh Ministers. The terms of contract for senior employees who are the ET members is based on the organisation's terms and conditions. The remuneration policy for the most senior staff is not subject to collective bargaining and the remuneration package by reference to the utilisation of the Job Evaluation for Senior Posts (JESP) and a spot salary. The pay is increased by the same percentage as Grade 11 (the most senior non-director pay grade).

Service contracts

All appointments to the Board are made on behalf of the organisation's sponsor minister in Welsh Government.

The Chief Executive and ET members are expected to be employed under permanent contracts. Appointments are made in accordance with our recruitment policy, which requires appointment to be made on merit and based on fair and open competition.

Unless otherwise stated below, the ET members covered by this report hold appointments which are permanent. These officers and Board members are required to provide three months’ notice of their intention to leave.

Salary and pension entitlements

The following sections provide details of the remuneration of members of the Board and the remuneration and pension interests of members of the ET. Board members are not entitled to join the Civil Service Pension Scheme or receive other benefits. Early termination, other than for misconduct, would result in the ET members receiving compensation consistent with the Civil Service Compensation Scheme. Board members are not entitled to compensation.

Salary

Salary covers both pensionable and non-pensionable amounts and includes gross salary, overtime and any allowances or payments that are subject to UK taxation. It does not include amounts which are a reimbursement of expenses directly incurred in the performance of an individual’s duties.

Performance-related pay

Any increase in salary for ET is subject to performance being assessed as either ‘Outstanding’ or ‘Achieving’ by the Chief Executive and moderation by the PCC. The increase applied will be determined by the pay award applied for those within the collective bargaining unit. Where performance is deemed to be underperforming then no pay increase is applied.

Benefits in kind

The monetary value of benefits in kind covers any benefits provided by the employer and treated by the HM Revenue & Customs as a taxable emolument. None of the Board members or ET received benefits in kind during 2023/24 and 2022/23.

None of the Board members or executive team received any remuneration other than the amounts shown below.

Board members’ remuneration

|

Board Member |

Board and Committee Roles (During 2023/24) |

Contracted Dates |

Salary 2023/24 (£5,000 range) |

Salary 2022/23 (£5,000 range) |

|---|---|---|---|---|

|

Karen Balmer |

N/A |

09/11/15 to 31/03/23 |

N/A |

10-15 |

|

Catherine Brown |

N/A |

01/11/18 to 31/10/22 |

N/A |

5-10 |

|

Julia Cherrett |

N/A |

01/11/18 to 31/05/23 |

0-5 |

15-20 |

|

Geraint Davies |

N/A |

01/01/19 to 31/10/24 |

10-15 |

10-15 |

|

Peter Fox |

FRMC Chair |

16/02/23 to 31/10/26 |

15-20 |

0-5 |

|

Paul Griffiths |

N/A |

01/09/21 to 25/05/22 |

N/A |

0-5 |

|

Sir David Henshaw |

Chair of Board |

01/11/18 to 31/10/25 |

45-50 |

45-50 |

|

Zoë Henderson |

N/A |

09/11/15 to 08/05/23 |

0-5 |

10-15 |

|

Calvin Jones |

LEC Chair |

01/09/21 to 31/10/28 |

15-20 |

10-15 |

|

Lesley Jones |

N/A |

01/06/23 to 31/10/26 |

10-15 |

N/A |

|

Rhys Jones |

N/A |

16/02/23 to 31/10/27 |

10-15 |

0-5 |

|

Mark McKenna |

PCC Chair |

01/09/21 to 31/10/28 |

15-20 |

10-15 |

|

Steve Ormerod |

Deputy Chair of Board & Chair EAC from November |

01/11/18 to 31/10/25 |

15-20 |

15-20 |

|

Kathleen Palmer |

ARAC Chair |

16/02/23 to 31/10/26 |

15-20 |

0-5 |

|

Helen Pittaway |

FC Chair |

16/02/23 to 31/10/26 |

15-20 |

0-5 |

|

Rosie Plummer |

PrAC Chair |

01/11/18 to 31/10/24 |

15-20 |

15-20 |

|

Peter Rigby |

EAC Chair to October |

01/11/18 to 31/10/23 |

5-10 |

15-20 |

Executive Team’s remuneration

|

Executive Team Member |

Salary (£5,000 range) 2023/24 |

Benefits in kind (nearest £100) 2023/24 |

Pension benefits (nearest £1,000) 2023/24 |

Total (£5,000 range) 2023/24 |

|---|---|---|---|---|

|

Clare Pillman (Chief Executive) |

150-155 |

0 |

40,000 |

190-195 |

|

Rachael Cunningham |

125-130 |

0 |

46,000 |

170-175 |

|

Ceri Davies |

125-130 |

0 |

37,000 |

160-165 |

|

Prys Davies |

105-110 |

0 |

30,000 |

135-140 |

|

Sarah Jennings |

130-135 |

0 |

51,000 |

180-185 |

|

Gareth O’Shea |

115-120 |

0 |

32,000 |

145-150 |

|

Executive Team Member |

Salary (£5,000 range) 2022/23 |

Benefits in kind (nearest £100) 2022/23 |

Pension benefits (nearest £1,000) 2022/23 |

Total (£5,000 range) 2022/23 |

|---|---|---|---|---|

|

Clare Pillman (Chief Executive) |

145-150 |

0 |

negative 10,000 |

135-140 |

|

Rachael Cunningham |

115-120 |

0 |

21,000 |

140-145 |

|

Ceri Davies |

115-120 |

0 |

negative 2,000 |

115-120 |

|

Prys Davies |

100-105 |

0 |

10,000 |

110-115 |

|

Sarah Jennings |

120-125 |

0 |

49,000 |

170-175 |

|

Gareth O’Shea |

110-115 |

0 |

negative 48,000 |

60-65 |

Executive team's remuneration notes:

- The value of pension benefits accrued during the year is calculated as the real increase in pension multiplied by 20, plus the real increase in any lump sum, less contributions made by the individual. The real increase is calculated by deducting the opening valuation from the end valuation. The real increases exclude increases due to inflation or any changes due to a transfer of pension rights. Inflationary increases are excluded by applying a real increase factor to the value at the start of the year.

For changes in levels of pay, the increase in pension due to additional service may not be sufficient to offset the inflation increase – that is, in real terms, the pension value can reduce, hence the negative values.

This value does not represent an amount that will be received by the individual. It is a calculation that is intended to convey to the reader of the accounts an estimation of the benefit that being a member of the pension scheme could provide. The pension benefit table provides further information on the pension benefits accruing to the individual.

Pension benefits

|

Executive Team member |

Accrued Pension at pension age as at 31/03/24 £000 |

Accrued Lump Sum at pension age as at 31/03/24 £000 |

Real Increase in pension at pension age £000 |

Real Increase in Accrued Lump Sum at pension age £000 |

CETV at 31/03/24 £000 |

CETV at 31/03/23 £000 |

Real Increase in CETV £000 |

|---|---|---|---|---|---|---|---|

|

Clare Pillman (Chief Executive) |

75-80 |

145-150 |

2.5-5 |

0 |

1,675 |

1,503 |

24 |

|

Rachael Cunningham |

40-45 |

0 |

2.5-5 |

0 |

807 |

709 |

29 |

|

Ceri Davies |

65-70 |

80-85 |

2.5-5 |

0 |

1,404 |

1,261 |

24 |

|

Prys Davies |

35-40 |

90-95 |

0-2.5 |

0 |

780 |

696 |

16 |

|

Sarah Jennings |

10-15 |

0 |

2.5-5 |

0 |

177 |

115 |

39 |

|

Gareth O’Shea |

65-70 |

100-105 |

0-2.5 |

0 |

1,407 |

1,268 |

19 |

The final salary pension of a person in employment is calculated by reference to their pay and length of service. The pension will increase from one year to the next by virtue of any pay rise during the year. For changes in pay, the increase in pension due to extra service may not be sufficient to offset the inflation increase – that is in real teams, the pension value can reduce. Where the movement in accrued lump sum value is negative in real terms, this is reported in the table above as £0.

During the year, the Government’s Actuary Department issued revised factors to be used, For consistency, the opening CETV has been calculated using the new factors and therefore the opening CETV disclosed here is different to the closing CETV reported in the equivalent table within the 2022/23 report.

Any members affected by the Public Service Pensions Remedy were reported in the 2015 scheme for the period between 1 April 2015 and 31 March 2022 in 2022/23 but are reported in the legacy scheme for the same period in 2023/24.

Cash equivalent transfer values (CETV)

A Cash Equivalent Transfer Value (CETV) is the actuarially assessed capitalised value of the pension scheme benefits accrued by a member at a particular point in time. The benefits valued are the member’s accrued benefits and any contingent spouse’s pension payable from the scheme. A CETV is a payment made by a pension scheme or arrangement to secure pension benefits in another pension scheme or arrangement when the member leaves a scheme and chooses to transfer the benefits they have accrued in their former scheme. The pension figures shown relate to the benefits that the individual has accrued as a consequence of their total membership of the pension scheme, not just their service in a senior capacity to which disclosure applies.

The figures include the value of any pension benefit in another scheme or arrangement which the member has transferred to the Civil Service pension arrangements. They also include any additional pension benefit accrued to the member as a result of their buying additional pension benefits at their own cost. CETVs are worked out in accordance with The Occupational Pension Schemes (Transfer Values) (Amendment) Regulations 2008 and do not take account of any actual or potential reduction to benefits resulting from Lifetime Allowance Tax which may be due when pension benefits are taken.

Real increase in CETV

This reflects the increase in CETV that is funded by the employer. It does not include the increase in accrued pension due to inflation or contributions paid by the employee (including the value of any benefits transferred from another pension scheme or arrangement) and uses common market valuation factors for the start and end of the period.

Compensation for loss of office

No compensation for loss of office was agreed during 2023/24 or 2022/23.

Fair pay disclosure

We and similar bodies are required to disclose the relationship between the remuneration of the highest paid director in their organisation and the median remuneration of the organisation’s workforce. Total remuneration includes salary and benefits in kind where applicable. It does not include severance payments, employer pension contributions and the CETV.

In 2023/24, 1 contractor (2022/23: 3) was charged at a rate in excess of the highest-paid director.

The banded remuneration of the highest paid director (as shown above) in the financial year 2023/24 was £150,000 to £155,000 (2022/23: £145,000 to £150,000). This was 3.8 times (2022/23 3.8 times) the median remuneration of the workforce, with comparison in respect of upper, median, and lower quartile remuneration presented in the following table.

Whole Workforce Remuneration ratio

|

Remuneration ratio |

2023/24 (£) |

2022/23 (£) |

Movement (%) |

|---|---|---|---|

|

Upper quartile |

46,673 |

46,003 |

1.46 |

|

Ratio |

3.3 |

3.2 |

N/A |

|

Median |

40,426 |

38,492 |

5.02 |

|

Ratio |

3.8 |

3.8 |

N/A |

|

Lower quartile |

35,686 |

32,876 |

8.55 |

|

Ratio |

4.3 |

4.4 |

N/A |

Staff pay scales range from £24,242 to £76,259 (2022/23: £21,655 to £72,627).

The percentage increase in salary, benefits in kind and performance related pay during the year was:

|

Staff |

Movement % |

|---|---|

| Highest paid director | 5.0 |

| All workforce | 1.2 |

| Directly employed | 5.0 |

As required by the Financial Reporting Manual, included within workforce in the tables above are permanent employees, fixed term appointments, apprentices, secondees, agency staff and contractors, where the pay has been calculated on an annualised basis.

All staff report

Staff Remuneration policy

There is a social partnership agreement in place with five trade unions and the setting of terms and conditions for staff below the ET members is through collective agreement with the social partners. The Welsh Government approves any changes to pay, terms and conditions and gives a pay remit to the organisation within which it must deliver. This year’s pay was for the period 1 April 2023 to 31 March 2024 and saw a 5% increase to our pay bill. As an accredited employer of the Real Living Wage Foundation, we applied the new rate (£12) in November and backdated it to April 2023. A pay award of 5% was applied to this and all pay points and enhancements and payments (allowances) but excluded the Loyalty Award and Market Supplement. This offer did not apply, as already agreed through Job Evaluation consultation, to those who had previously opted out of the Job Evaluation Scheme.

In recognition of the impact that cost of living pressures was having on our staff and similar to other public sector bodies, we made a one-off payment of £1,500 to all staff, excluding Executive Team, in September 2023. This was separate to the pay award.

This report provides information on the composition and costs of our workforce. Included in the staff tables below are permanent employees, fixed-term appointments, apprentices as well as agency staff, contractors, secondees.

Number of staff by headcount and full time equivalent (FTE) at 31 March 2024

Male:

| Employees | Headcount | FTE |

|---|---|---|

| All employees | 1,350 | 1,319 |

| Leadership Team | 15 | 15 |

| Executive Team | 2 | 2 |

Female:

| Employees | Headcount | FTE |

|---|---|---|

| All employees | 1,186 | 1,116 |

| Leadership Team | 13 | 12 |

| Executive Team | 4 | 4 |

Total:

| Employees | Headcount | FTE |

|---|---|---|

| All employees | 2,536 | 2,435 |

| Leadership Team | 28 | 27 |

| Executive Team | 6 | 6 |

Number of staff by headcount and full time equivalent (FTE) at 31 March 2023

Male:

| Employees | Headcount | FTE |

|---|---|---|

| All employees | 1,391 | 1,364 |

| Leadership Team | 13 | 13 |

| Executive Team | 2 | 2 |

Female:

| Employees | Headcount | FTE |

|---|---|---|

| All employees | 1,168 | 1,097 |

| Leadership Team | 14 | 13.5 |

| Executive Team | 4 | 4 |

Total:

| Employees | Headcount | FTE |

|---|---|---|

| All employees | 2,559 | 2,461 |

| Leadership Team | 27 | 26.5 |

| Executive Team | 6 | 6 |

Average number of full-time equivalent persons paid during the year was:

|

Full-time equivalent persons paid |

Permanent Staff (2023/24) |

Others (2023/24) |

Total (2023/24) |

Total (2022/23) |

|---|---|---|---|---|

|

Directly employed |

2,295 |

76 |

2,371 |

2,232 |

|

Agency and contract staff |

0 |

91 |

91 |

158 |

|

Total |

2,295 |

167 |

2,462 |

2,390 |

The average full-time equivalent number of staff working on capital projects was

216.7 (2022/23: 246.1).

Staff turnover

Staff turnover during 2023/24 was 5% excluding temporary workers e.g., fixed term appointments (2022/23 4.9%).

Staff costs

|

Staff costs and other expenditure for staff |

Permanent staff - 2023/24 (£'000) |

Other staff - 2023/24 (£'000) |

Total - 2023/24 (£'000) |

Total - 2022/23 (£'000) |

|---|---|---|---|---|

|

Wages and salaries |

99,303 |

8,842 |

108,145 |

98,571 |

|

Social security costs and other taxation |

10,742 |

778 |

11,520 |

10,180 |

|

Other pension costs |

23,970 |

686 |

24,656 |

21,978 |

|

Total net salary costs |

134,015 |

10,290 |

144,321 |

130,729 |

|

Other expenditure for staff |

N/A |

Note |

N/A |

N/A |

|

Exit package costs |

N/A |

N/A |

13 |

81 |

|

IAS 19 (pensions) service charge |

N/A |

16 |

6,988 |

14,855 |

|

Less early retirement pension costs |

N/A |

N/A |

Negative 5 |

78 |

|

Less in-year LGPS pension contributions |

N/A |

N/A |

Negative 6,894 |

Negative 6,894 |

|

Movement in accrued holiday pay |

N/A |

N/A |

15 |

138 |

|

Total other expenditure for staff |

N/A |

N/A |

117 |

Negative 8,258 |

|

Less amounts charged to capital projects |

N/A |

N/A |

Negative 12,956 |

Negative 14,136 |

|

Total staff costs |

N/A |

N/A |

131,482 |

124,851 |

Details of our pension obligations can be found in Note 16 of the Financial statements and notes to the accounts. [CHECK LINK]

Details of the remuneration of Board members and directors are in the remuneration report. Bought-in services in Note 5 (other expenditure) includes £4.7 million of expenditure on consultants (2022/23 £5.5 million).

During the year, the methodology applied to calculate expenditure on consultants has been amended, with the corresponding 2022/23 figure also updated for consistency.

Pension schemes

We are a member of two pension schemes. The Principal Civil Service Pension Scheme (PCSPS) is an open scheme and includes both the defined benefit scheme, Alpha, as well as the stakeholder partnership defined contribution scheme. We are also a closed member of the Environment Agency Pension Fund (EAPF) under a community admission agreement. Further details of these pension schemes are shown below.

Civil Service Pension Scheme contributions

The PCSPS and the Civil Servant and Other Pension Scheme (CSOPS) - known as "Alpha" - are unfunded multi-employer defined benefit schemes, but the schemes do not identify individual organisations’ share of the underlying assets and liabilities. The latest full actuarial valuation of the PCSPS as at 31 March 2020 was completed in September 2023. You can find details in the resource accounts of the Cabinet Office: Civil Superannuation here.

For 2023/24, employer’s contributions of £6,899k were payable to the PCSPS (2022/23: £14,855k) at one of four rates in the range 26.6% to 30.3% of pensionable earnings (for 2022/23 26.6% to 30.3%), based on salary bands. The Scheme Actuary reviews employer contributions usually every four years following a full scheme valuation. The contribution rates are set to meet the cost of the benefits accruing during 2023/24 to be paid when the member retires and not the benefits paid during this period to existing pensioners.

Stakeholder partnership pensions

Employees can opt to open a partnership pension account, a stakeholder pension with an employer contribution. Employer’s contributions of £169k (2022/23: £156k) were paid to the appointed stakeholder pension provider. Employer contributions are age-related and range from 8% to 14.75%. Employers also match employee contributions of up to 3% of pensionable earnings. In addition, employer contributions of £5k, 0.5% of pensionable pay (2022/23 £5k), were payable to the PCSPS to cover the cost of the future provision of lump sum benefits on death in service or ill health retirement of these employees.

No contributions were due to the partnership pension providers at the balance sheet date, and no contributions were prepaid.

Local Government Pension Scheme (LGPS) contributions

We makes payments to the EAPF, as the administering authority for the LGPS via Capita, the pension fund administrators.

The LGPS is a funded, statutory, defined contribution public service pension scheme. Every three years the EAPF undertakes a valuation in conjunction with the Scheme Actuary. The 31 March 2022 valuation assessed the EAPF financial position with a funding level of 103% (2019: 106%). The main purpose of the actuarial valuation is to review the financial position of the fund and to set the level of future contributions for employers in the fund.

We have a community admission agreement with the EAPF to participate in the LGPS, which was approved by the Secretary of State for Communities and Local Government in respect of former Environment Agency Wales staff who transferred to the organisation on 1 April 2013. The liabilities for former members employed by the Environment Agency in respect of Welsh functions (pensions in payment and deferred members) also transferred. The WG has entered into a guarantee with the EAPF to indemnify them for any liabilities that arise from the participation of NRW in the EAPF.

For 2023/24 the employer's contribution rate was 22.50% (2022/23: 23.76%) In 2023/24 employer's contributions of £6,894k were paid to the LGPS (2022/23: £6,894k) which reduces the balance on the IAS 19 pension fund.

3 persons (2022-23: 2 persons) retired early on ill-health grounds; the total additional accrued pension liabilities in the year amounted to £55k (2022-23: £34k).

Exit packages

|

The total number of exit packages by cost band |

2023/24 |

2022/23 |

|---|---|---|

|

Under £10,000 |

1 |

4 |

|

£10,001 - £25,000 |

1 |

2 |

|

£25,001 - £50,000 |

0 |

1 |

|

£50,001 - £100,000 |

0 |

0 |

|

£100,001 - £150,000 |

0 |

0 |

|

Total |

2 |

7 |

|

Resource cost |

£13,000 |

£88,000 |

There were no compulsory redundancies in 2023/24 or 2022/23.

Voluntary exit costs have been paid in accordance with provisions of the Civil Service Compensation Scheme, a statutory scheme made under the Superannuation Act 1972. The table above shows the total cost of exit packages agreed and accounted for in 2023/24. Exit costs of £27k were actually paid in 2023/24, the year of departure. Where we have agreed early retirements, the additional costs are met by this organisation and not by the Civil Service pension scheme. Ill-health retirement costs are met by the pension scheme and are not included in the table.

Sickness absence (not subject to audit)

Our sickness absence rate for the rolling year (1 April 2023 to 31 March 2024) showed an average of 5.4 days lost per employee and equates to 2.4%.

Disability Policies (not subject to audit)

Disability Confident Employer

During 2023/24, we continued to be compliant with our ‘Two Ticks’ guaranteed interview scheme where applicants who declare themselves as disabled, in line with the Equality Act 2010 definition, and meet the minimum criteria for the role applied for, are automatically invited to interview.

Externally we received applications from 2,163 people of which 92 (4.25%) people requested a guaranteed interview. Internally we received applications from 533 people of which 10 (1.87%) people requested a guaranteed interview. These figures are with a backdrop of implementing a recruitment freeze in August 2023.

Employee Resource Groups (ERG) - Staff Networks (not audited)

Employee Resource Groups (ERG), also known as Employee or Staff Networks are a supportive and welcoming space for our colleagues to come together to create change in the workplace. ERGs are often centred around an under-represented protected characteristic in the workplace. The networks provide our colleagues with the opportunity to meet with colleagues from across the organisation and get involved with network activities.

ERGs also carry out the essential tasks of creating new diversity and inclusion good practices influencing those in charge to implement them.

During this year, two new ERGs were set up to support our colleagues, namely the Women’s Staff Network and the Sight Impaired Staff Network under the wider Disability Employee Resource Group.

Each of our ERGs have a dedicated intranet page with information relevant to each group which all colleagues have access to.

We currently have nine Employee Resource Groups that represent protected characteristic themes, namely Disability, Sex and Gender, Sexual Orientation, Religion and Belief. These are:

- Assisted User Group

- Calon- The LGBTQ+ Staff Network

- Christian Fellowship Staff Network

- Cwtch - The Carers Network

- Dementia Friends Network

- Muslim Staff Network

- Neurodiversity Staff Network

- Sight Impaired Network

- The Women’s Network

Each ERG has a lead, or the role is carried out jointly with another colleague. These roles are carried out voluntarily and provide colleagues with a safe space and someone to contact when support is required. A good practice guidance was devised with the support of the ERG which outlined the aims and objectives of Networks, and role of Network leads for consistency. The guidance also provides a framework to support their mental health and wellbeing and to balance their day job and role as Network Leads, as well as succession planning.

ERG Leads are also encouraged by the Equalities Team to make more use of Webinar Wednesdays especially in raising awareness of significant D&I dates such as Neurodiversity Awareness Week, LGBTQ+ History Month and International Women’s Day.

Off-payroll engagements (not subject to audit)

We are required to publish information about appointments of consultants or staff that last longer than 6 months and where the individuals earn more than £245 per day, where we pay by invoice rather than through payroll. The off payroll working rules were designed to ensure that if someone works through an intermediary and would have been regarded, for income tax and national insurance contributions purposes, as an employee if they were directly engaged by the organisation, they pay broadly the same income tax and national insurance contributions as if they were employed. These rules do not apply to people who are genuinely self-employed.

It is the responsibility of the organisation to undertake the assessment for tax purposes as opposed to the intermediary. If the determination of the assessment is that the role is inside scope of IR35, the intermediary will pay the same employee tax as a pay‑rolled employee.

The following tables show our position in relation to these requirements.

Off-payroll engagements as of 31 March 2024, for more than £245 per day

|

Number of existing engagements at 31 March 2024 that have existed for: |

Number of contractors |

|---|---|

|

less than one year |

0 |

|

between one and two years |

2 |

|

between two and three years |

1 |

|

between three and four years |

4 |

|

four or more years |

3 |

|

Total |

10 |

New off-payroll engagements between 1 April 2023 and 31 March 2024, for more than £245 per day

|

New engagements |

Number of contractors |

|---|---|

|

The number of new engagements, or those that reached six months in duration, between 1 April 2023 and 31 March 2024 |

1 |

|

Of which the number assessed as caught by IR35 |

0 |

|

Of which the number assessed as not caught by IR35 |

1 |

|

Of which the number engaged directly and are on the organisation's payroll |

0 |

|

Of which the number of engagements reassessed for consistency / assurance purposes during the year |

0 |

|

Of which the number of engagements that saw a change to IR35 status following the consistency review |

0 |

Parliamentary and Audit Report (audited)

Losses and special payments

The Welsh Government's managing public money rules require disclosure of losses and special payments by category, type, and value where they exceed £300,000 in total and for any individual items of £300,000 or more.

Individual losses of £300,000 or more

There were no losses or special payments of £300k or more during 2023/24.

Losses and special payments by category

The table below provides the number of write offs and special payment requests approved in the year.

|

Category or type of loss |

2023/24 Number |

2023/24 £’000 |

2022/23 Number |

2022/23 £’000 |

|---|---|---|---|---|

|

Write-off of irrecoverable debts |

70 |

80 |

161 |

222 |

|

Loss of assets |

3 |

16 |

10 |

44 |

|

Other losses (cash losses, fruitless payments, unenforceable claims, or gifts) |

15 |

241 |

5 |

49 |

|

Special payments |

7 |

71 |

8 |

63 |

|

Total |

95 |

408 |

184 |

378 |

|

Waiver of income (Waiver of income mostly relating to future sales and does not relate to credit notes to be raised against historical invoices) |

9 |

164 |

0 |

0 |

|

Total |

104 |

572 |

184 |

378 |